Measuring and improving the performance of customs valuation controls

Our study emphasizes the importance for customs to combine all available sources of information, internal and external to customs administrations, in order to fight fraud more effectively. Specifically, it stresses the value of confronting mirror data on trade discrepancies with customs’ internal data on fraud records at the product level. This approach is followed to elaborate an indicator of customs controls' efficiency, that can also be used to target ex post these controls towards the riskiest import products, and therefore to improve revenue mobilization.

Nowadays, customs administrations have to both collect revenue and facilitate trade. Fighting more effectively evasion while facilitating more legal trade requires customs inspectors to select only the riskiest declarations. In this context, we propose new tools to assess the efficiency of inspections and to detect uncovered fraud.

These tools result from the combination of administrative data (import declarations registered in the local integrated customs management system) with mirror data (exports flows reported by the exporting country to the United Nations Statistics Division). First, we compute, for each product classification (tariff heading), the difference between exports flows declared by the exporting country and corresponding imports flows reported by the importing (local) country. Second, it is possible to confront these discrepancies to internal frauds recorded during customs frontline controls, to check whether customs interventions are targeted on the riskiest products, i.e. products with the greatest discrepancies in trade statistics. Following this approach, it is possible to get a synoptic view of the overall efficiency of customs valuation controls, through a graph showing, for each product classification, the share of estimated undetected fraud before and after frontline controls.

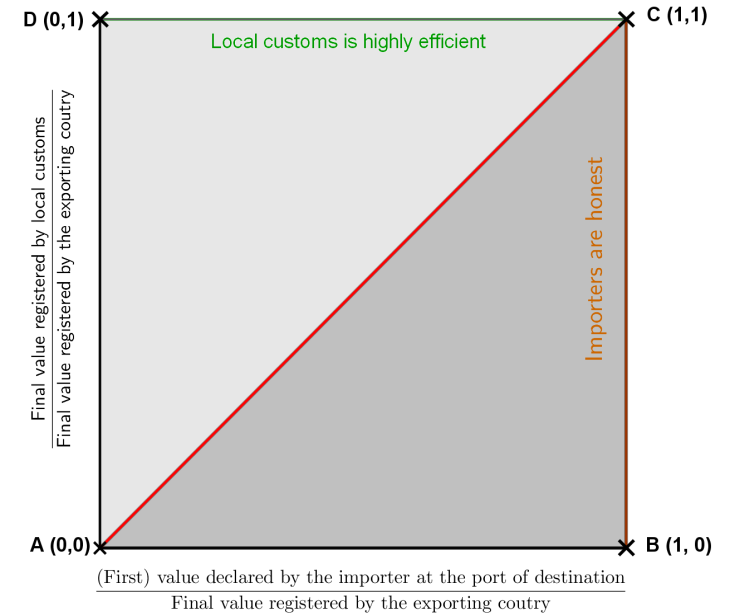

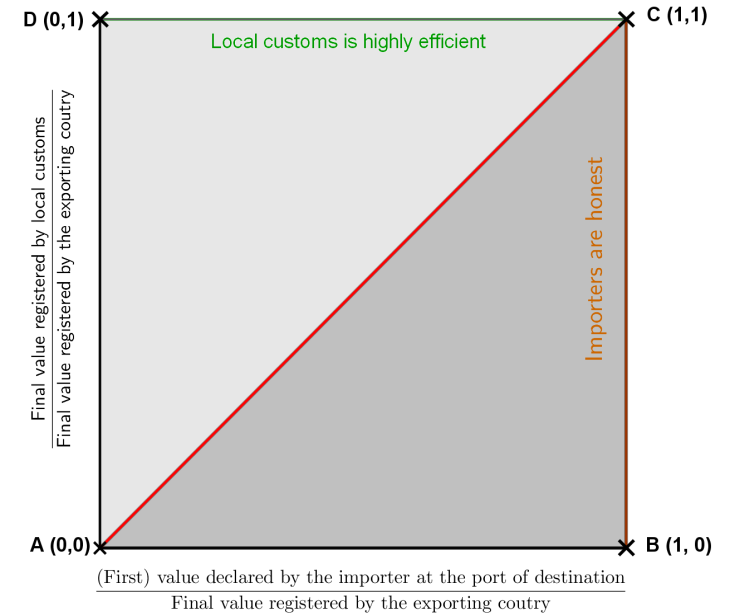

While the x-axis represents the initial customs fraud, that is, the value initially reported by the importer relative to the value registered by the exporting country, the y-axis represents the final customs fraud, that is, the value registered by local customs after customs controls relative to the value registered by the exporting country. When the y-axis value is close to one (i.e., near to the horizontal green line), customs inspections are extremely efficient. Likewise, when the x-value is close to one (i.e., near to the vertical orange line), it indicates that importers are honest.

In case of upward revisions made during frontline controls on a specific product, the y-axis’ ratio values are greater than the x-axis’ ratio values. The corresponding observation point is therefore located above the 45° diagonal line passing through the origin (the red line displayed in the above figure). If the observation point is situated on the 45° diagonal line, it means that customs have not detected any fraud on this product.

The above synoptic view of the efficiency of customs valuation controls can be usefully supplemented with a synthetic indicator of the efficiency of customs. For each product classification, we measure the gap between the size of revisions actually made by the local customs administration on imports values and the size of revisions a fully effective inspection would have yielded, taking as reference the value reported by the exporting country.

Applied to Gabon customs, our study suggests that customs intervention did not increase imports declared value for most tariff headings. In spite of this relative inefficiency, it is worth mentioning that the efficiency of customs controls is higher on some specific tariff headings (e.g. imports of wickerwork), with greater potential for revenue mobilization.

The introduction of our indicators - built on clear, objective and transparent criteria-, should greatly promote efficiency and create virtuous behaviors in customs administrations which in turn will support both trade facilitation and revenue mobilization.