International economic integration has brought about a dramatic rise not only in the trade in final goods, but also in intermediate goods. Several studies have empirically and theoretically demonstrated that

importing intermediate inputs implies relevant productivity gains, as firms can access a larger number of input varieties, a better input quality, and/or a more advanced technology embodied in foreign inputs (Ethier, 1982; Markusen, 1989; Amiti and Konings, 2007; Goldberg et al., 2010).

At the same time,

increasing trade across countries has generated an important debate about the impact of globalisation on the environment. For example, it has been argued that trade reforms may shift pollution-intensive activities to countries with weaker environmental standards, implying an increase in global pollution; also referred to as the pollution haven hypothesis (Pethig, 1976; McGuire, 1982). However, empirical works on the linkage between trade and the environment do not provide a clear verdict. Evidence on the effect of trade and trade policy reform on environmental performance at the detailed firm level are scarce and mainly focus on firms’ decision to export in an industrialised country context (e.g. Girma et al., 2008; Batrakova and Davies, 2012).

Our paper contributes to the existing literature by studying the impact of foreign intermediate inputs (rather than exports) on firms’ productivity and environmental performance, in the context of a developing country. We first build a

simple theoretical framework, mainly based on Krugman (1980) and Ethier (1982), with two vertically-related sectors, where symmetric firms supply their varieties under monopolistic competition in a closed economy. Firms in the downstream sector produce final good varieties, by mainly using energy and intermediate inputs, which are in turn produced by firms in the upstream sector. Next, we analyse how trade integration of intermediate input markets across similar countries affect the firm-level energy intensity, in addition to productivity. We assume that only a given fraction of final good producers can import, whereas the other firms are not able to do so. We show that firms that enter intermediate input markets increase, on average, their productivity, and reduce their energy intensity, compared with non-importing firms. In other words, through importing, firms have access to a larger range of differentiated intermediate inputs, which entails not only a more efficient usage of intermediates itself (productivity gains à la Ethier, 1982), but also a more efficient usage of energy, implying positive effects for the environment (environmental gains from input varieties).

We test the theoretical predictions by using

firm-level data on manufacturing firms in Indonesia covering the time period 1991 to 2005. Using propensity-score matching and difference-in-difference techniques, the empirical findings support the results of our model. Our baseline findings suggest that the access to foreign intermediate inputs results, on average, in additional energy efficiency (productivity) gains of up to 12.7% (29.2%) for new importers compared to their never-importing counter-parts.

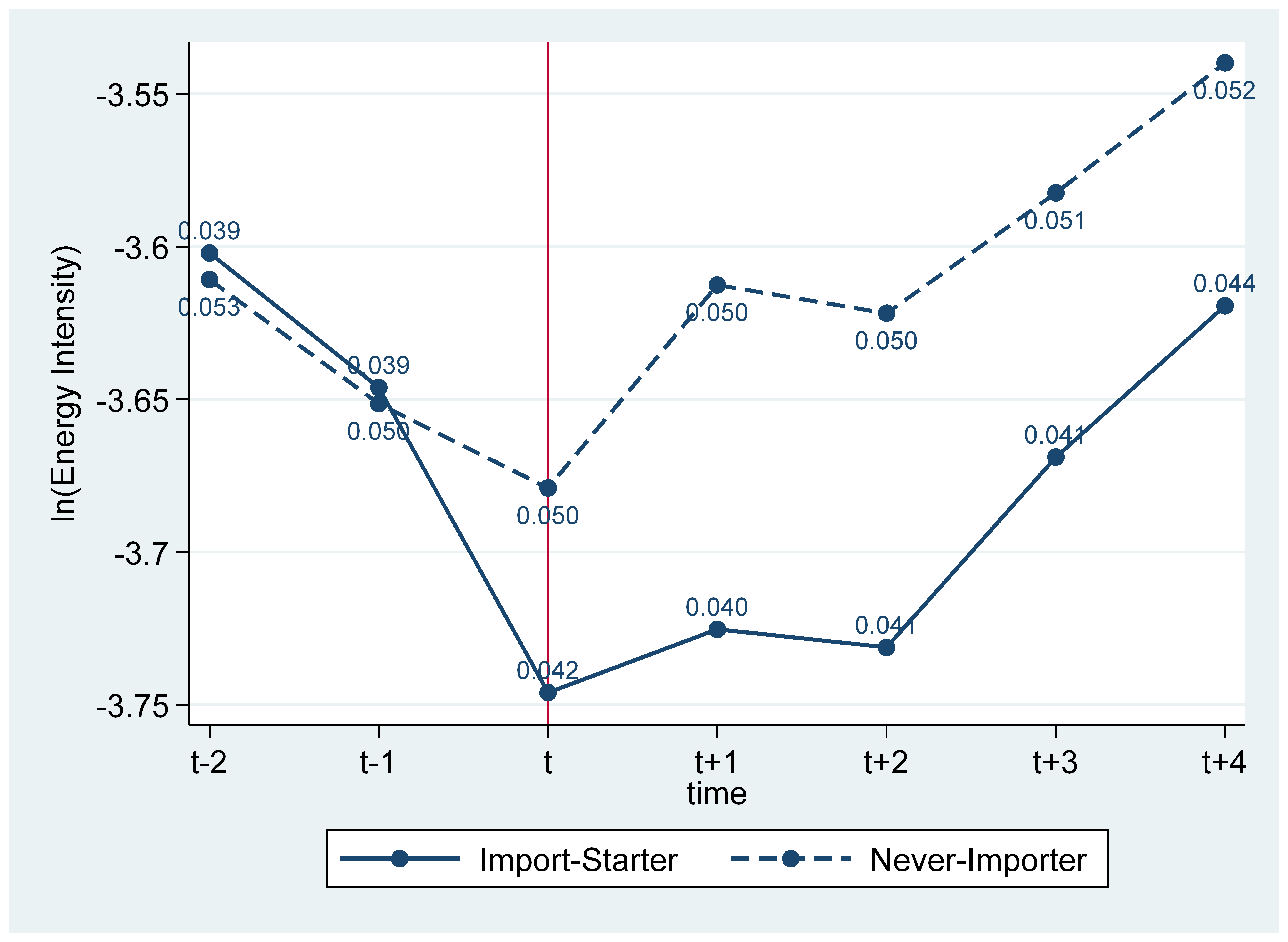

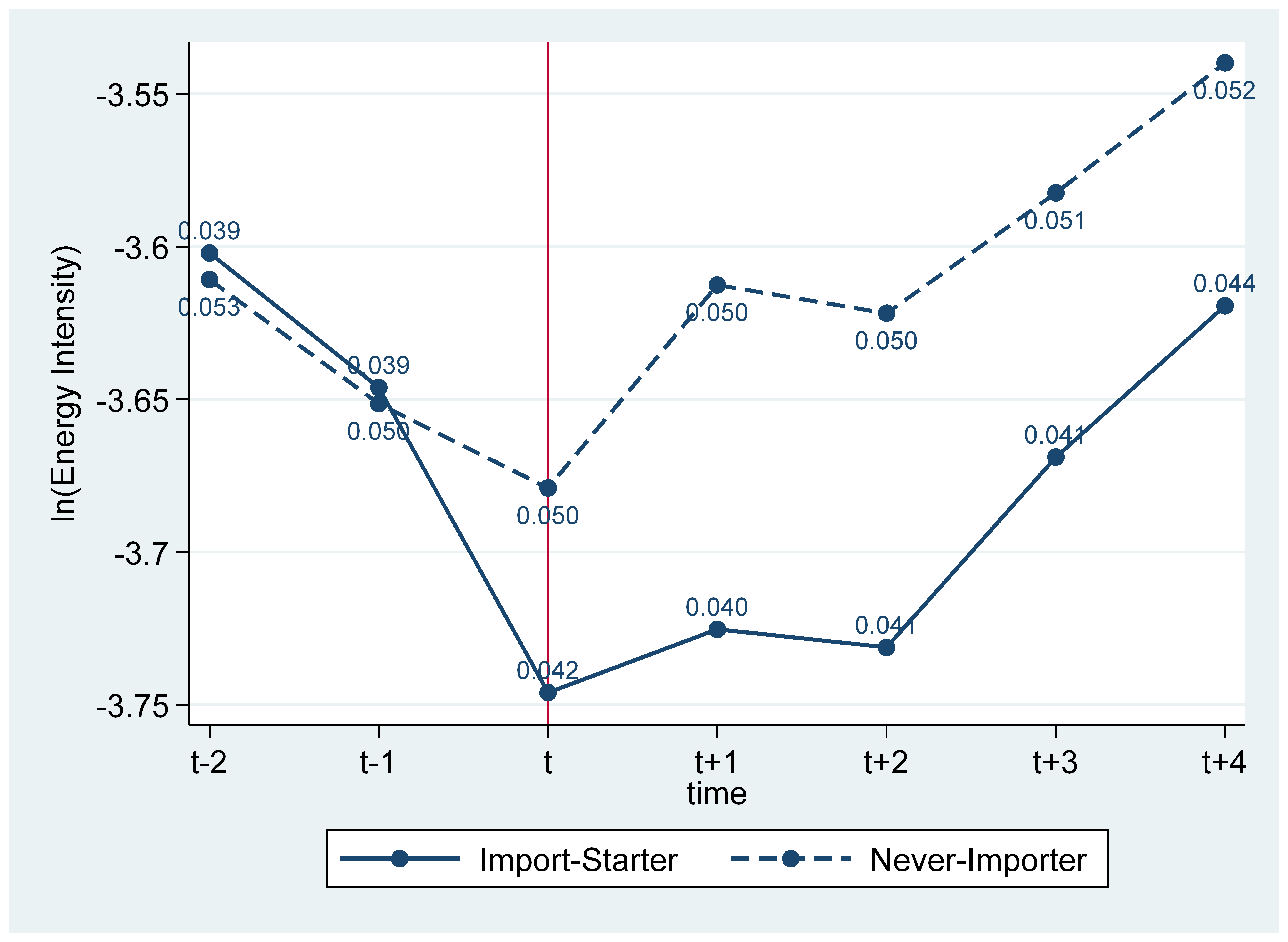

Figure 1 illustrates our findings through a simple graph plotting the average energy efficiency of matched import starters and never-importing firms, side by side, both before and after the entry into foreign input markets. Time period t denotes the entry period into importing. The figure shows that matching seems to have produced a set of import-starting and never-importing firms that were, by and large, on parallel downward energy efficiency trajectories before the start of importing at time t. At the moment of import market entry t (as firms start to import) the two trends start to diverge. As for the period following import market entry (i.e. time t+1) the divergence still continues, and starts to fade out during the period t+2.

Finally, we also examine whether the firm-level energy efficiency gains from imports occurred through the access to a greater number of intermediate varieties, as highlighted in our theoretical model. Due to the lack of detailed firm-level data on imported varieties, we use Indonesian product-level data on imports from the United Nation’s WITS database and Indonesia's Input-Output Table to build an input variety index for each industry. We then link this information with our firm-level data, and we show that the magnitude of the energy efficiency improvements almost doubles in size for firms starting to import in industries associated with a large number of imported intermediate inputs, when compared to our baseline findings. For import starters in in sectors associated with a small number of foreign intermediate inputs, the coefficients, by and large, halve and become statistically insignificant.

Our results may hence carry important implication as they tend to suggest that

trade liberalisation and access to foreign intermediate input markets may generate important economic but also environmental benefits for producers in emerging markets.

References

Amiti, M., Konings J., 2007,

Trade Liberalization, Intermediate Inputs, and Productivity: Evidence from Indonesia, American Economic Review, 97(5), 1611-1638.

Batrakova, S., Davies, R. B., 2012,

Is there an environmental benefit to being an exporter? Evidence from firm-level data, Review of World Economics, 148(3), 449-474.

Ethier, W. J., 1982,

National and international returns to scale in the modern theory of international trade, American Economic Review, 72 (3), 389–405.

Goldberg, P. K., Khandelwal A. K., Pavcnik N., Topalova P., 2010,

Imported Intermediate Inputs and Domestic Product Growth: Evidence from India, The Quarterly Journal of Economics, 125(4), 1727-1767.

Girma, S., Hanley, A., Tintelnot, F., 2008,

Exporting and the environment: A new look with microdata (Kiel Working Paper No. 1423). Kiel: Kiel Institute for the World Economy.

Krugman, P.. 1980.

Scale Economies, Product Differentiation, and the Pattern of Trade, American Economic Review, 70 (5), 950-59.

Markusen, J. R., 1989,

Trade in Producer Services and in Other Specialized Intermediate Inputs, American Economic Review, 79(1), 85.95.

McGuire, M. C., 1982,

Regulation, factor rewards, and international trade, Journal of Public Economics, 17(3), 335–354.

Pethig, R., 1976,

Pollution, welfare, and environmental policy in the theory of comparative advantage. Journal of Environmental Economics and Management, 2(3), 160-169.